Challan 280 is one way to pay your advance tax, regular assessment tax, self-assessment tax, additional charges etc. online. Let’s discuss how.

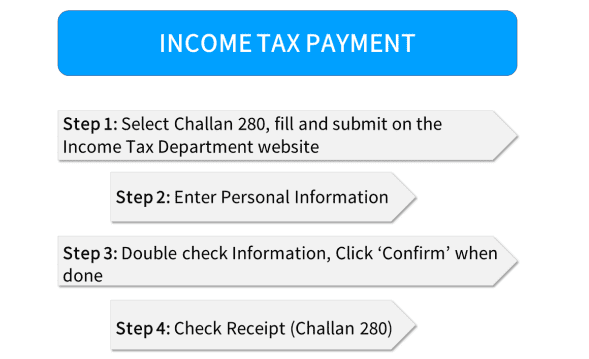

1. Steps to Pay Income Tax Online:

Step 1: Select Challan 280

Go to the tax information network of the Income Tax Department and click on ‘Proceed’ under Challan 280 option.

Step 2: Enter Personal Information

For individuals paying tax:

Step 1: Select (0021) Income Tax (Other than Companies).

Step 2: Select the type of payment correctly from the following:

- (100) Advance Tax

- (102) Surtax

- (106) Tax on Distributed Profit

- (107) Tax on Distributed Income

- (300) Self Assessment Tax

- (400) Tax on Regular Assessment

Select ‘Self-assessment tax’, if you have any taxes due to pay while filing your income tax returns.

Step 3: Select the mode of payment you wish to choose. There are two modes of payment available – Net banking or Debit Card

Step 4: Select relevant Assessment Year (AY). For the period 1st April 2019 – 31st March 2020 the relevant AY is 2020-21

Step 5: Enter your complete address

Step 6: Enter Captcha in the given space and click on ‘Proceed’.

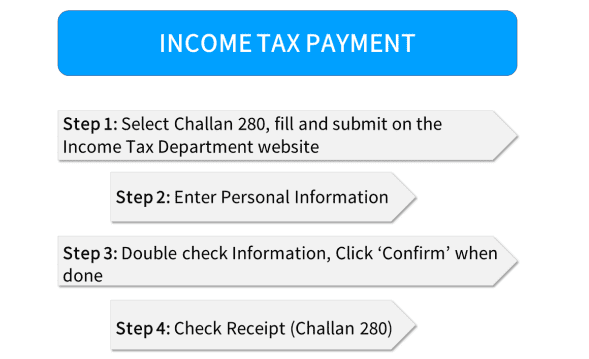

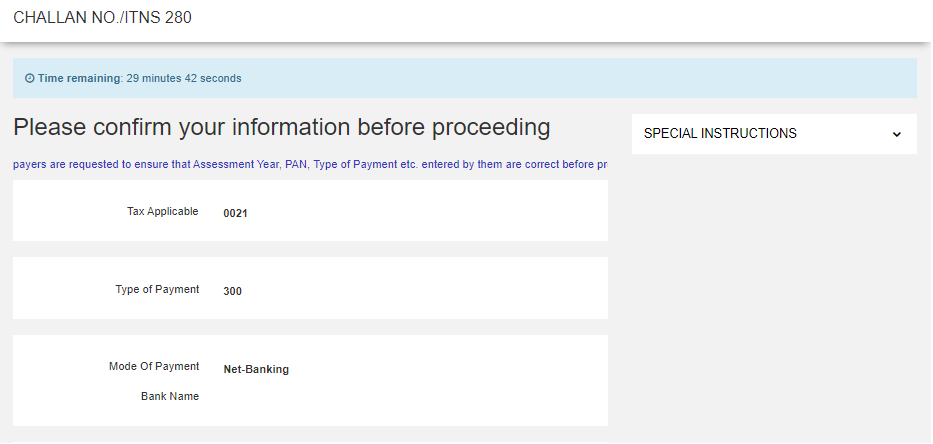

Step 3: Double check Information

Double-check the information displayed and you will have to submit the request to the bank. Then, you will be redirected to your bank’s payment page.

Step 4: Check Receipt (Challan 280)

After completing the payment, you’ll get a tax receipt on the next screen where you can see the payment details. You can see the BSR code and challan serial number on the right side of the challan.

and It's Done :)

3. Advance Tax

If you have annual tax dues exceeding Rs 10,000, you must pay income tax in advance. Usually, for the salaried class, employers take care of these income tax payments via TDS deductions.

a. Situations when you have to pay advance tax:

i. You are salaried but have high income from interest or capital gains or rental income

ii. You are a freelancer

iii. You are running a business

b. How to Calculate and Pay Advance Tax?

Add income from all sources. Include salary income, interest income, capital gains etc., just like you do at the time of filing your income tax return. If you are a freelancer, estimate your annual income from all clients, and deduct expenses from it. Rent of your workplace, internet bills, mobile bills, depreciation on computers, travel expenses etc. are some expenses.

c. How to determine and allow deductions

Reduce deductions you want to claim from your total income and arrive at your taxable income on your tax return. The deductions that come under Section 80C, 80D, 80E or any other you want to claim.

d. How to calculate tax due on total income

Apply the latest income tax slab rates on your taxable income to calculate your income tax due. Reduce any TDS that may have been deducted from your total tax due. And make sure you have paid according to these instalments. You can make these payments online.

Our CAs can calculate your advance tax liability and help you with paying it online. Seeing a large tax outgo? Don’t worry, our CAs can help calculate your freelancing income and make sure your taxes are optimised.

Due Dates of Payment of Advance Tax for FY 2018-19

| Dates | For Individuals |

| On or before 15th June | Up to 15% of advance tax |

| On or before 15th September | Up to 45% of advance tax less advance tax already paid |

| On or before 15th December | Up to 75% of advance tax less advance tax already paid |

| On or before 15th March | Up to 100% of advance tax less advance tax already paid |

Non-payment of advance tax can result in penal interest levy under section 234B and 234C.

4. Self Assessment Tax

You cannot submit your income tax return to the Income Tax Department unless you have paid tax dues in full. Sometimes, you may see tax payable at the time of filing your return. This tax is called Self Assessment Tax, which you can pay online to ensure successful e-filing. You should also pay the interest under section 234B and 234C along with your tax due, if you are paying tax after 31 March. When you e-file with ClearTax, our system will automatically tell you how much tax you need to pay to file your return. You can also get your return verified from a CA to make sure that you paid the correct amount.

5. Outstanding Demand Payment

Sometimes, you may have to make an income tax payment to comply with an income tax demand notice. If you agree with the assessing officer and are ready to pay the demand, you may do so online. It is also called the tax on regular assessment.