May 18, 2022

What is the new tax regime for FY 2020-21?

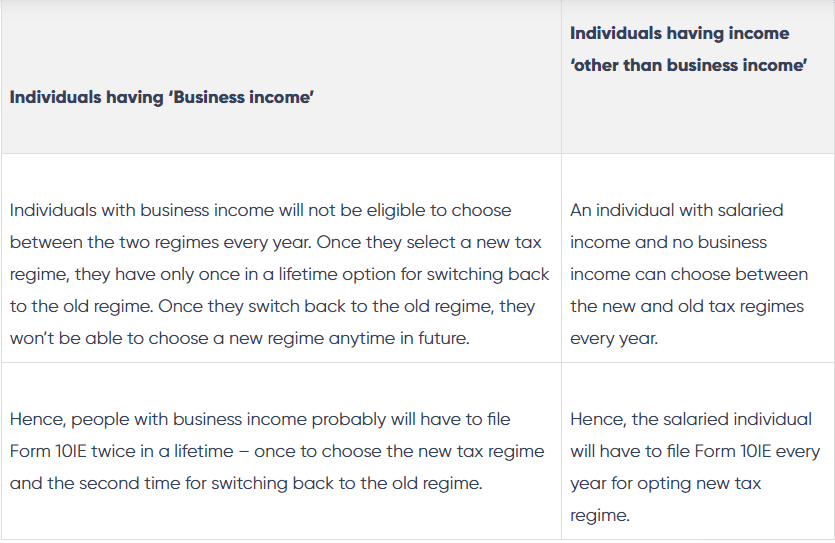

The Budget 2020 introduces a new regime under section 115BAC giving an option to individuals and HUF taxpayers to pay income tax at lower rates. The new system is applicable for income earned from 1 April 2020 (FY 2020-21), which relates to AY 2021-22.

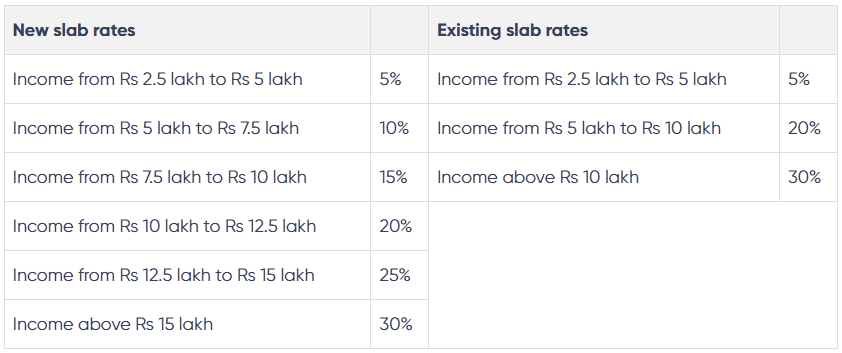

What are the tax rates under the new regime?

The tax rates under the new tax regime and the existing tax regime are:

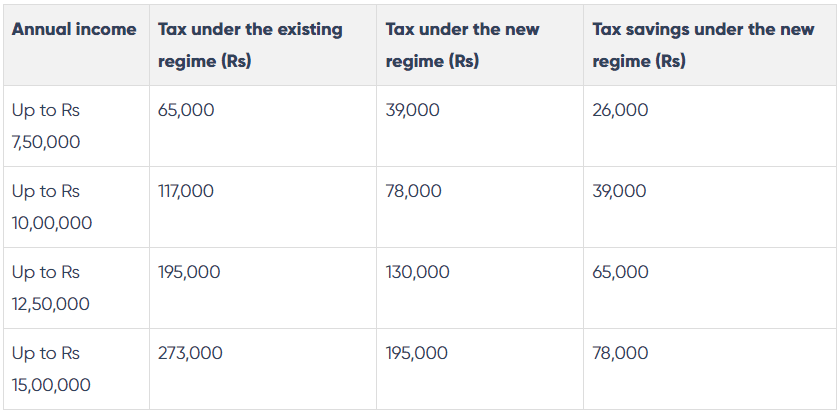

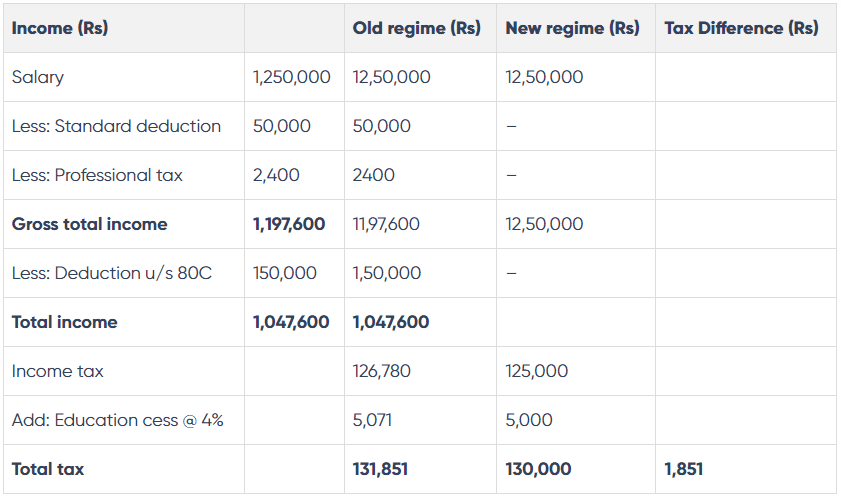

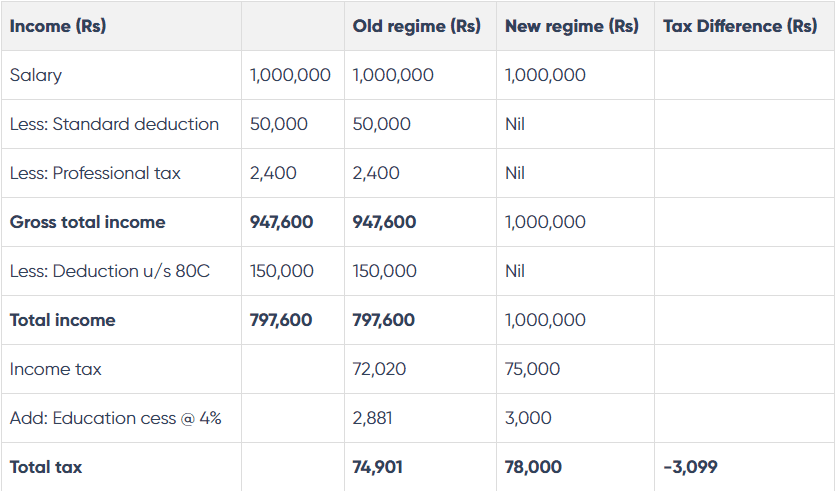

The new tax regime does not allow 70 deductions and exemptions (discussed in para 4). The tax payable under both the latest and the existing regimes without claiming deductions and exemptions is as below:

The new tax regime saves taxes for taxpayers who don’t claim any deductions or exemptions.