May 18, 2022

Change in Authorised & Paid Up Capital/Contribution in Company/LLP

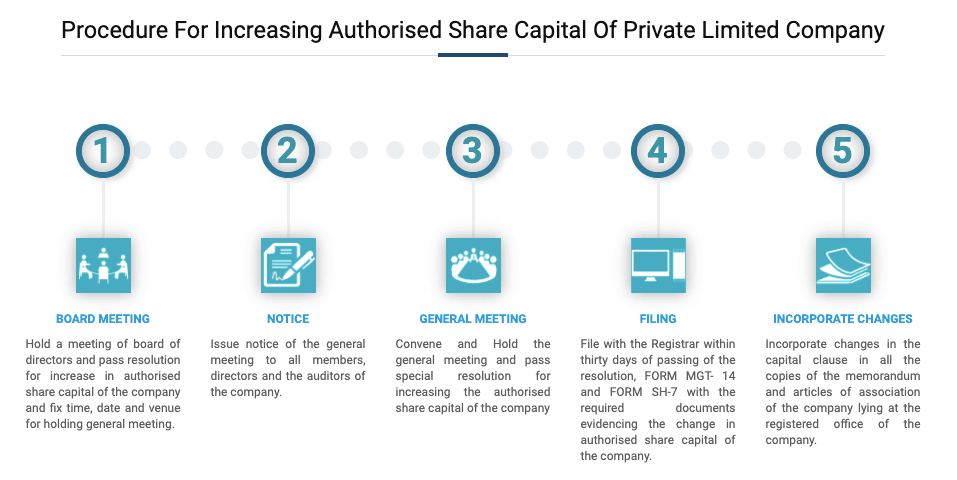

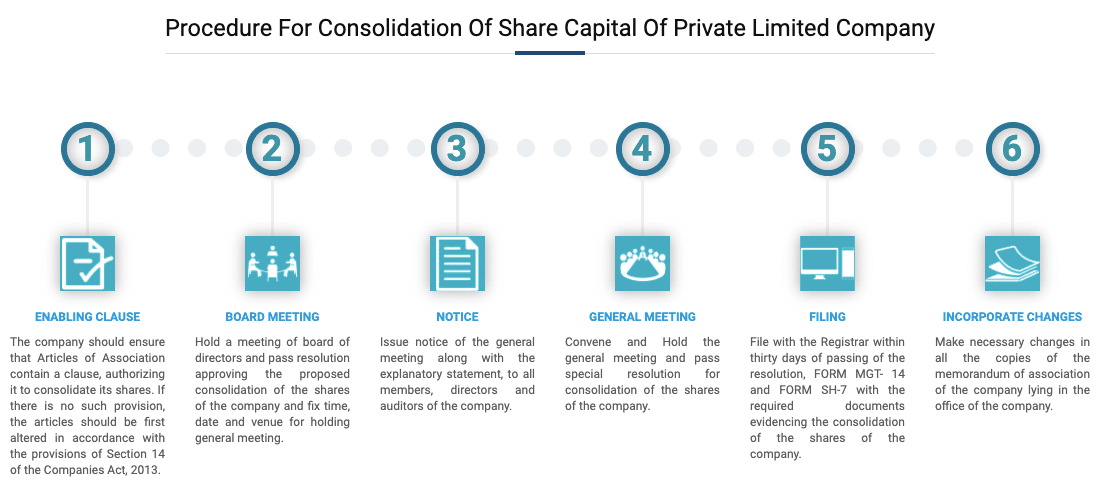

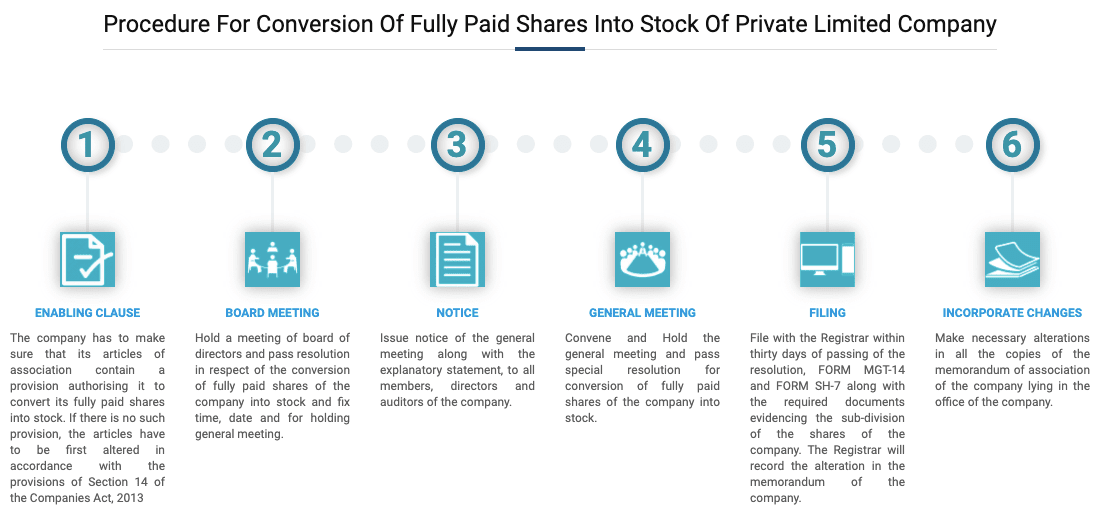

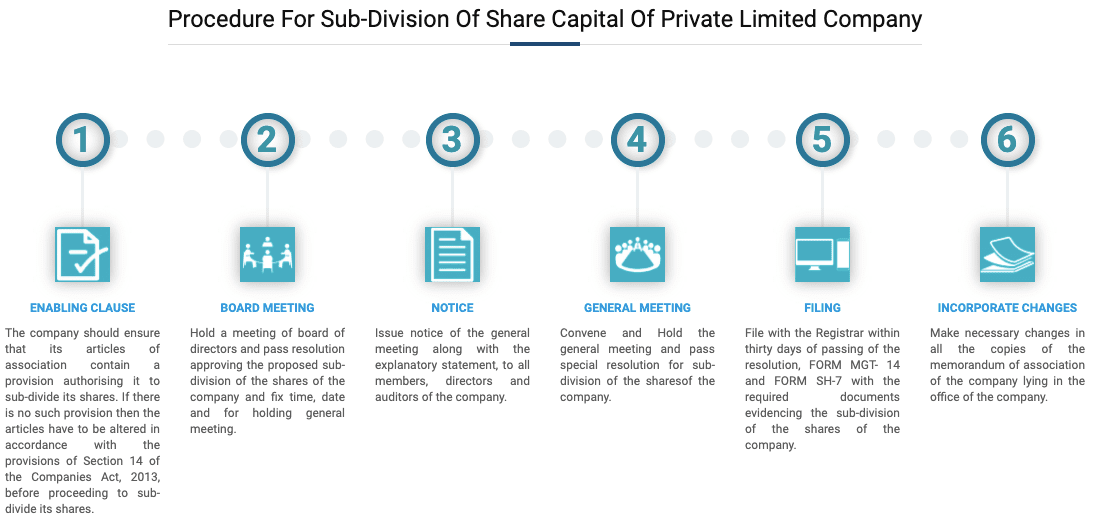

Every Public or Private company 'limited by shares' must have a share capital. Share capital refers to the amount invested in the company to carry out its day to day operations or business activities. The company's share capital can be altered or increased, subject to certain conditions as prescribed in law. A company cannot issue share capital over the limit specified in the capital clause without changing the capital clause of the memorandum of association.

- Purchase the plan

- Provide details required for changing the capital

- Get secretarial services to draft various documents such as disclosure, resolutions, etc

- Financy Anzalist files SH-7 & related on your behalf